Abstract

This study examines the significant impact of Sri Lanka’s apparel industry on the nation’s economy, primarily through its contribution to Gross Domestic Product (GDP). By analyzing export performance data, the research highlights the crucial role the apparel sector plays in driving economic growth. Utilizing secondary data from internet sources, journal articles, and books, the study employs statistical tools such as SPSS and Microsoft Excel for data analysis. Findings reveal that Sri Lanka’s garment industry, characterized by large-scale factories, significantly contributes to export earnings and job creation. The industry’s products are widely exported to major markets, including the European Union and the United States. Over the past five years, the apparel sector has consistently been a major contributor to the country’s export earnings, indicating a strong positive relationship between the apparel industry and Sri Lanka’s economy.

Introduction

The Economy of Sri Lanka

Sri Lanka’s economy is assessed based on its Gross Domestic Product (GDP), which quantifies the total value of goods and services produced within the country. Historically, from independence in 1948 until the late 1950s, Sri Lanka maintained a closed economy, transitioning to an open economy in 1977. This shift invited foreign investment and spurred industrial sector growth, marking a significant move from an agrarian-based economy towards industrialization, with notable growth in the apparel sector.

Economic growth in Sri Lanka has been robust in recent years, with an average annual growth rate of 6.3% from 2002 to 2013. During this period, GDP per capita increased from US$859 in 2000 to US$3,256 in 2013, demonstrating substantial economic advancement (World Bank, 2015).

Sectorial Composition in Gross Domestic Product

Traditionally an agrarian economy, Sri Lanka has progressively embraced industrialization to boost economic development. The Central Bank of Sri Lanka’s 2014 annual report highlights the changing sectorial composition of the GDP, underscoring the growing importance of the industrial sector, particularly the apparel industry.

Impact of the Apparel Industry

Sri Lanka’s apparel industry has evolved into a pivotal component of its economy. Dominated by large-scale factories producing high-quality garments for export markets, this concentration has enabled the sector to secure a substantial portion of the country’s export earnings while generating significant employment opportunities. The industry’s exports reach numerous countries worldwide, including major markets in the European Union and the United States.

Over the past five years, the apparel industry has consistently outperformed other sectors in terms of export earnings, demonstrating its critical role in the national economy. The research identifies a positive correlation between the apparel industry’s performance and Sri Lanka’s economic health, affirming that the sector is a vital driver of economic growth.

In conclusion, the apparel industry is a cornerstone of Sri Lanka’s economy, significantly contributing to GDP and export earnings. The industry’s sustained performance underscores its importance in the broader economic landscape of the country.

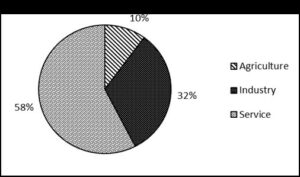

Figure 1: Sectorial Composition in Gross Domestic Product

Source: Central Bank of Sri Lanka, 2014

Industrial Sector: A Pillar of Sri Lanka’s Economic Growth

The Industrial Sector’s Contribution to GDP

In Sri Lanka, the service sector leads the economy, contributing 58% to the GDP, while the agricultural sector lags with only a 10% contribution. The industrial sector stands as the second-largest contributor, accounting for 32% of the GDP. Notably, the industrial sector experienced significant growth, expanding by 11.4% in 2014 compared to 9.9% in 2013. This growth was driven by positive contributions from all major sub-sectors, increasing the industrial sector’s share of GDP from 31.1% in the previous year to 32.3% (Central Bank of Sri Lanka, 2014).

Role of the Industrial Sector in Sri Lanka’s Economy

The impressive growth of Sri Lanka’s industrial sector can be attributed to four main sub-sectors: construction, manufacturing, mining and quarrying, and electricity, gas, and water supply. Each of these sub-sectors has played a critical role in bolstering the industrial sector and, consequently, the national economy.

- Construction: This sub-sector exhibited the highest growth rate, surging by 20.2% in 2014. The construction boom has been pivotal in driving the overall growth of the industrial sector.

- Manufacturing: Although the manufacturing sub-sector had the second-lowest growth rate at 8.0% in 2014, it remains a crucial part of the industrial sector. It encompasses the processing of agricultural products, factory industries, and cottage industries.

- Mining and Quarrying: This sub-sector recorded the highest growth within the industrial sector, expanding by 11.0% in 2014. The steady increase in mining and quarrying activities has significantly contributed to the sector’s overall growth.

- Electricity, Gas, and Water Supply: Despite having the lowest growth rate of 4.5% in 2014, this sub-sector is essential for supporting the infrastructure needed for industrial activities.

The collective growth of these sub-sectors highlights the industrial sector’s crucial role as a key driver of economic development in Sri Lanka. By consistently supporting and advancing these areas, Sri Lanka can secure sustained economic growth and make greater contributions to the national GDP.

Compared to the growth rates of the respective sub sectors accounted as follow.

Table 1: Growth Rates of Industrial sector

|

Year |

Mining and Quarrying |

Manufacturing |

Electricity, Gas and Water |

Construction |

| 2013 | 11.5 | 7.5 | 10.3 | 14.4 |

| 2014 | 11 | 8 | 4.5 | 20.2

|

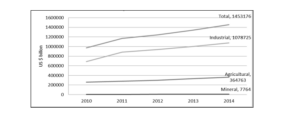

Figure 2: Growth Rates of Industrial sector

The Surge of Manufacturing and Construction Sectors in Sri Lanka’s Industrial Growth

Sectoral Performance and GDP Contributions

Recent data reveals a significant increase in the manufacturing and construction sectors within Sri Lanka’s industrial landscape, whereas the mining and quarrying, as well as electricity, gas, and water supply sectors, have experienced a decline. Manufacturing stands as the largest industrial sub-sector, contributing 18% to the GDP, followed by construction at 7%. Meanwhile, mining and quarrying, along with electricity, gas, and water, contribute 1.5% and 2% to the GDP, respectively (Central Bank of Sri Lanka, 2014).

Manufacturing Sub-Sector: Dominance of Factory Industry

The manufacturing sub-sector, encompassing the processing of agricultural products, factory industries, and cottage industries, plays a pivotal role in Sri Lanka’s industrial output. The factory industry, a significant component of this sub-sector, contributes approximately 16% to the GDP and experienced a growth rate of 8.5% in 2014, up from 7.8% in 2013 (Central Bank of Sri Lanka, 2014).

Within the factory industry, the textiles, apparel, and leather products sector emerge as the second-largest contributor, adding 20% of value. The food, beverage, and tobacco sector lead as the largest contributor, contributing 44%, followed by the chemical, petroleum, rubber, and plastic products sector.

Growth Drivers in the Factory Industry

The robust performance of export-oriented industries, particularly textiles, wearing apparel, and leather products, significantly fueled the factory industry’s growth. In 2014, these industries recorded a substantial growth of 11.5%, while the chemical, petroleum, coal, rubber, and plastic products sector grew by 8.5%.

The apparel sector, a major export industry and a dynamic contributor to the economy, continued its growth trajectory with an impressive 19.7% increase in 2014. Sri Lanka’s apparel industry is highly regarded globally for its reliable, high-quality manufacturing that adheres to ethical practices, such as being free of child and forced labor and maintaining eco-friendly standards.

Factory Industry Production Index (FIPI)

The Factory Industry Production Index (FIPI), measuring output in manufacturing, mining, electricity, and gas industries, showcases the apparel industry’s sustained growth. Using 2010 as the base year, the FIPI for the apparel sector displays a continuous rise: 113.8 in 2011, 118.5 in 2012, 128.5 in 2013, and 132.9 in 2014. The apparel industry holds the highest share within the factory industries, comprising 30% of the total FIPI, surpassing the combined contributions of food products and beverages, which account for 21% and 8%, respectively.

The upward trends in the manufacturing and construction sectors underscore their critical roles in Sri Lanka’s economic development. The factory industry’s diverse sub-sectors, especially the apparel industry, are key drivers of this growth, reinforcing the industrial sector’s significant contribution to the nation’s GDP. By continuing to nurture these sectors, Sri Lanka can ensure sustained economic progress and enhanced industrial output.

Table 1: The composition of Factory Industry Production Index (FIPI)

| Industry | 2010 | 2011 | 2012 | 2013 | 2014 |

| Food Products | 100 | 108.7 | 106.9 | 105.3 | 103.4 |

| Beverages | 100 | 110.2 | 107.4 | 103 | 111.8 |

| Tobacco Products | 100 | 106 | 99.9 | 96.7 | 87.6 |

| Textiles | 100 | 100.9 | 113.9 | 128.5 | 132.9 |

| Wearing Apparel | 100 | 113.8 | 118.5 | 126.5 | 149.5 |

| Leather and Related Products | 100 | 94 | 92.9 | 98.3 | 98.2 |

| Wood and Products of Wood, | 100 | 107.9 | 98.4 | 114.6 | 108.9 |

| except Furniture

Paper and Paper Products |

100 |

88.3 |

98.8 |

127 |

126.6 |

| Printing and Reproduction of | 100 | 100.5 | 106.3 | 110.3 | 112.4 |

| Recorded Media

Refined Petroleum Products |

100 |

106.3 |

81.3 |

83.4 |

86 |

| Chemicals and Chemical | 100 | 95.3 | 78.1 | 74.1 | 82.2 |

| Products

Pharmaceuticals, Medicinal |

100 |

133 |

138.8 |

185.1 |

142.8 |

| Chemical and Botanical Products

Rubber and Plastic Products |

100 |

116.5 |

116.9 |

118.2 |

134.2 |

| Other Non-metallic Mineral | 100 | 116.7 | 117.5 | 103.2 | 102.9 |

| Products

Basic Metals |

100 |

115.5 |

98.1 |

100 |

112.9 |

| Fabricated Metal Products, | 100 | 89.6 | 111.7 | 136.5 | 97.1 |

| except Machinery and Equipment Electrical Equipment |

100 |

98.7 |

98.4 |

107.6 |

99.5 |

Source: Central Bank of Sri Lanka, 2014

Evolution of Sri Lanka’s Export Composition: From Agriculture to Industry

Transformation Through Economic Liberalization

The liberalization of Sri Lanka’s economy in 1977 marked a pivotal shift, particularly for the garment industry, which experienced rapid growth following the policy change (Industry Capability Report, 2012). This move towards an open economy not only boosted the garment sector but also significantly increased export earnings across various sectors.

Sectoral Contributions to Total Exports

Sri Lanka’s export composition encompasses three main sectors: agricultural, industrial, and mineral, each playing a distinct role in shaping the country’s export profile.

- Agricultural Sector: Traditionally, Sri Lanka’s economy heavily relied on agriculture, with key exports including tea, rubber, coconut, and spices. Although the relative contribution of agriculture to total exports has diminished over time, it remains an important component of the export economy.

- Industrial Sector: Post-liberalization, the industrial sector, especially the garment industry, became a dominant force in Sri Lanka’s exports. This sector includes textiles, apparel, and leather products, which have experienced substantial growth due to increased global demand and competitive manufacturing practices.

- Mineral Sector: Although smaller in comparison, the mineral sector contributes to Sri Lanka’s exports with products such as graphite, mineral sands, and gemstones. While the sector’s development has been slower, it remains a valuable part of the export landscape.

Visual Representation of Export Composition

Figure 2 illustrates the composition of Sri Lanka’s total exports, highlighting the shift from an agriculture-dominated export economy to one where industrial products, particularly garments, play a significant role. This visual representation underscores the impact of economic liberalization and the strategic development of the industrial sector on the nation’s export dynamics.

Conclusion

The liberalization of Sri Lanka’s economy in 1977 was a turning point that catalyzed the growth of the garment industry and transformed the country’s export composition. While agriculture continues to be a foundational element, the industrial sector, led by garment exports, now plays a crucial role in driving economic growth and enhancing export earnings. This evolution reflects Sri Lanka’s adaptability and strategic leveraging of global market opportunities to bolster its economy.

Figure 2: Composition of Total Exports of Sri Lanka

Source: Central Bank of Sri Lanka, 2014

Dominance of the Apparel Industry in Sri Lanka’s Export Earnings

Overview of Sector Contributions to Export Earnings

Recent data shows a substantial long-term rise in all export sectors in Sri Lanka. The industrial sector is particularly notable, contributing 74.23% of total export earnings, followed by agricultural products at 25.1%, and the mineral sector at 0.53%.

Apparel Industry: The Leading Export Earner

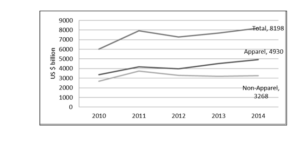

The Export Development Board (EDB) reports that Sri Lanka’s apparel industry emerged as its largest export earner, experiencing a 9.26% year-over-year (YOY) increase and generating $4.9 billion in revenue in 2014. This growth trajectory followed a substantial 13% YOY increase in 2013, where earnings soared to $4.5 billion, exceeding the industry’s initial target of $4 billion. Notably, the apparel sector’s exports have been subject to regulation under the Multi-Fibre Arrangement (MFA) since 1978, imposing export constraints aimed at safeguarding the garment industries in developed nations.

Despite the challenges posed by the MFA, the apparel industry has demonstrated resilience and prosperity. The Export Development Board’s 2015 data highlighted that textiles and apparel contributed 43% to Sri Lanka’s overall export earnings. Additionally, as per Abeysinghe (2014), apparel accounted for nearly 70% of Sri Lanka’s industrial exports. Nevertheless, Abeysinghe underscored the imperative for Sri Lanka to diversify its export portfolio to sustain long-term growth..

Conclusion

The apparel industry has solidified its position as the cornerstone of Sri Lanka’s export economy, consistently delivering substantial earnings and driving the dominance of the industrial sector. While long-term growth across all sectors is promising, the country’s reliance on apparel underscores the importance of exploring and developing additional export avenues to ensure continued economic vitality.

Figure 3: Export Earnings – Apparel Industry Vs. Other Industries

Source: Central Bank of Sri Lanka, (Various Issues)

Apparel Industry: The Driving Force Behind Sri Lanka’s Export Earnings

Dominance of the Apparel Industry in Export Growth

Recent data clearly shows that over the past five years, the apparel industry has had a significantly greater impact on Sri Lanka’s total export earnings compared to other industries. Both total export earnings and earnings from the apparel sector exhibit a long-term upward trend, whereas other industries show a declining trend in export earnings.

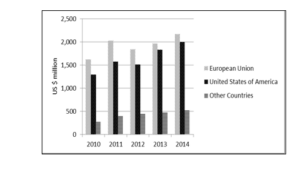

Global Demand for Sri Lankan Apparel

Sri Lankan apparel enjoys high demand in various international markets, particularly in European countries such as the United Kingdom, Italy, Germany, Belgium, and the Netherlands. Similarly, the United States also represents a significant market for Sri Lankan garments. Additionally, Canada, China, Hong Kong, Japan, and the United Arab Emirates are important buyers, contributing to the country’s export earnings (Central Bank of Sri Lanka, 2014).

The data reveals that the European Union leads in terms of the value of apparel exports, measured in US dollars, underscoring the region’s importance as a primary market for Sri Lankan apparel.

Conclusion

The apparel industry stands as the powerhouse of Sri Lanka’s export economy, consistently outperforming other sectors in contributing to export earnings. The sustained growth in apparel exports, particularly to key markets in Europe and North America, underscores the industry’s crucial role in propelling the country’s economic advancement. To sustain and augment this trajectory, Sri Lanka must persist in leveraging its strengths in apparel manufacturing while also venturing into new opportunities across other sectors.

Figure 4: Sri Lankan Apparel – Export Countries

Source: Central Bank of Sri Lanka, 2014

The Economic Backbone: Sri Lanka’s Apparel Industry

Dominance and Growth of the Apparel Export Industry

According to the Export Development Board (2013), Sri Lanka’s apparel export industry stands out as the most significant contributor to the nation’s economy, exhibiting remarkable growth over the past four decades. Presently, it reigns as the primary foreign exchange earner, accounting for 40% of total exports and an impressive 52% of industrial exports. Remarkably, the industry, entirely privately owned, has adeptly seized opportunities in the global market, establishing itself as a world-class manufacturer supplying renowned global brands for over thirty years (Export Development Board, 2015).

Ethical Practices and Employment Opportunities

Embracing high ethical standards and shunning practices like child and forced labor, Sri Lanka’s garment industry has earned global recognition as a producer of ‘Garments without Guilt’. Guided by this visionary slogan, ethical practices have been integral to the industry’s success. Furthermore, the industry demonstrates a strong commitment to workforce welfare, providing direct employment to over 300,000 individuals, a substantial proportion of whom are women. With around 350 garment factories spread across the country, the industry remains a significant contributor to employment and economic growth (Industry Capability Report, 2012).

Impact of Apparel Industry on Sri Lanka’s GDP

This study examines the impact of export performance in the apparel industry on Sri Lanka’s Gross Domestic Product (GDP). Utilizing secondary data, the study reveals a correlation between the economy and the apparel industry’s export performance. While the apparel industry has been a standout performer in Sri Lanka’s exports, its competitive advantage has diminished over time, as noted by Abeysinghe (2014). However, contrary to expectations, there hasn’t been a sharp decline in the industry’s contribution to the economy or employment. Instead, the findings indicate a weak positive relationship between the apparel industry’s export performance and GDP.

Continued Growth and Revenue

Despite challenges, the export performance of the apparel industry has gradually increased over the years, as confirmed by the Export Development Board (2015). With revenues nearing Rs. five billion in the last fiscal year, the apparel industry retains its position as the top foreign revenue earner, surpassing traditional exports such as tea, coconut, and tourism.

Conclusion

The apparel industry remains a cornerstone of Sri Lanka’s economy, driving export earnings and employment opportunities while upholding ethical standards. As the industry continues to evolve and adapt to global trends, its contribution to the nation’s GDP remains significant, underscoring its enduring importance in Sri Lanka’s economic landscape.

Table 2: Export Performance in Apparel Industry on GDP

Export Performance (USD)

| Year | GDP | $Million) |

| 2005 | 6.2 | 2747.78 |

| 2006 | 7.7 | 2917.06 |

| 2007 | 6.8 | 3144.31 |

| 2008 | 6 | 3282.44 |

| 2009 | 3.5 | 3119.89 |

| 2010 | 8 | 3178.21 |

| 2011 | 8.2 | 3985.78 |

| 2012 | 6.4 | 3776.13 |

| 2013 | 7.2 | 4264.89 |

| 2014 | 7.4 | 4681.50 |

Source: Central Bank (Various Issues)

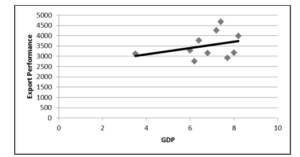

Figure 5: Relationship between Export Performance in Apparel Industry and GDP

Source: Export Development Board, 2015

The scatter plot diagram above illustrates the relationship between export performance in the apparel industry and the Gross Domestic Product (GDP) of Sri Lanka over the past decade. According to the diagram, there is a weak positive relationship between these two variables.

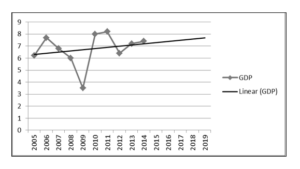

Figure 6: Trend in GDP of Sri Lanka

Source: Central Bank (Various Issues)

The above diagram shows fluctuations in the GDP of the country, and the forecasted GDP for the next five years are as follows: 7.29 in 2015, 7.39 in 2016, 7.49 in 2017, 7.58 in 2018, and 7.68 in 2019.

Shaping Sri Lanka’s Economy: The Influence of the Apparel Industry

Evolution of the Industrial Sector

The liberalization of Sri Lanka’s economy in 1977 marked a turning point, shifting the nation’s economic landscape. With this transition, the industrial sector’s impact on GDP surpassed that of the agricultural sector, leading to a significant rise in industrial activity. The garment industry, in particular, soared following the country’s economic liberalization, demonstrating immediate growth and becoming a key driver of industrial expansion.

Sectorial Composition of GDP

In Sri Lanka, the service sector claims the largest share of GDP, while the agricultural sector holds the lowest. The industrial sector bridges the gap between these two extremes, contributing significantly to the national economy as the second-largest sector.

Contribution of the Apparel Industry

Within the industrial sector, the apparel industry, classified under the Factory Industry, has played a pivotal role in driving overall growth, especially in the export market. Recent data indicates a substantial portion of total export earnings attributed to the industrial sector, highlighting its economic significance.

Global Reach of Sri Lankan Apparel

Sri Lankan apparel enjoys a broad international market, with exports reaching numerous countries worldwide, including major markets like the European Union and the United States.

Conclusion: Apparel Industry’s Economic Impact

The apparel export industry stands as the most significant contributor to Sri Lanka’s economy, showcasing remarkable growth over the past four decades. Its dominance as the primary foreign exchange earner underscores its pivotal role in shaping the nation’s economic landscape. Moreover, the correlation between the export performances of the apparel industry and the country’s GDP highlights the industry’s profound influence on Sri Lanka’s economy. In conclusion, the apparel industry’s growth and performance significantly impact the overall economy of Sri Lanka.

References: Exploring Sri Lanka’s Economic Landscape

- Abeysinghe, B. (2014). The time has come for Sri Lanka to look beyond apparel exports. Daily FT. Retrieved from http://www.ft.lk/2014/03/21/the-time-has-come-for-sri-lanka-to-look-beyond-apparel-exports/

- Central Bank of Sri Lanka. (2005-2013). Annual Reports of Central Bank of Sri Lanka. Retrieved from various years’ reports at http://www.cbsl.gov.lk/

- Export Development Board (EDB). (2012). Industry Capability Report of Export Development Board. Retrieved from http://www.srilankabusiness.com/buyers/industry-capability-profile/

- Export Development Board (EDB). (2015). Performance of the Export Sector of Sri Lanka Report of Export Development Board. Retrieved from http://www.srilankabusiness.com/pdf/performance_of_exports_2014.pdf

- Industry in Sri Lanka. (2013). Retrieved from http://www.tradechakra.com/economy/sri-lanka/industry-in-sri-lanka-350.php

- Lakshman, W. D. & Tisdell, C.A. (1997). Sri Lanka’s Development from Independent-Socio-Economic Perspectives and Analyses. Huntington, New York: NOVA Science Publishers.

- http://repository.kln.ac.lk/handle/123456789/10625

These references provide valuable insights into various aspects of Sri Lanka’s economy, including the role of the apparel industry, sectorial composition of GDP, and the impact of export performances.