Introduction….

- Individual income taxation is pivotal in the fiscal architecture of nations, serving not only as a primary revenue source but also as a potent tool for socioeconomic policy. This comparative analysis delves into the intricate tax structures of two South Asian countries, India and Sri Lanka. With vibrant economies and distinct cultural contexts, these nations provide an engaging terrain to examine the diverse strategies employed in shaping fiscal policies. By unraveling the complexities of their income tax frameworks, this study aims to illuminate shared challenges, unique nuances, and consequential impacts on the citizens of these burgeoning economies.

Context and Significance:

- In the pursuit of economic growth and stability, India and Sri Lanka have embarked on transformative journeys characterized by shifts in political landscapes, globalization, and technological advancements. Against this backdrop, individual income taxation emerges as a linchpin in the financial strategies of these nations. The significance of comprehending the intricacies of their tax structures lies in their direct correlation to economic policies that shape the quality of life for citizens and the overall trajectory of national development.

Historical Perspectives:

- Tracing the historical evolution of individual income taxation provides a lens through which we can discern the trajectories of economic development in India and Sri Lanka. Historical markers such as tax reforms, policy changes, and responses to economic challenges contribute to the narrative of how each country has calibrated its tax system over time. This temporal exploration unveils the factors that have shaped the current tax landscapes, offering insights into the underlying philosophies and responses to shifting economic paradigms.

Tax Principles and Frameworks:

- At the core of this analysis lie the fundamental principles and frameworks that underpin the individual income tax systems in India and Sri Lanka. Elements such as progressive taxation, tax brackets, allowances, and deductions serve as the building blocks of these frameworks. By dissecting these principles, we gain a comprehensive understanding of how each country structures its tax policies to balance the needs of revenue generation and socio-economic equity.

Comparative Analysis:

- Through a comparative examination, this study scrutinizes the variances and commonalities in the individual income tax systems of India and Sri Lanka. Parameters such as tax rates, thresholds, and treatment of different income sources will be meticulously compared to delineate the distinct approaches adopted by each nation. This comparative lens aims to unveil patterns and disparities, fostering a deeper appreciation of the impact of tax

- structures on the financial landscape of

- individual taxpayers.

Implications and Future Trends:

- The implications of the current individual income tax structures extend beyond immediate financial considerations. They influence economic behavior, income distribution, and the overall fiscal health of a nation. As this analysis progresses, attention will be devoted to foreseeing potential trends and challenges that may shape the future of income taxation in India and Sri Lanka. Anticipating these trajectories is essential for policymakers and stakeholders as they chart the course for robust and equitable fiscal policies.

- In delving into the intricate details of the individual income tax structures of India and Sri Lanka, it is imperative to conduct a comprehensive analysis of key components that shape these fiscal policies. This middle section of our study will focus on tax rates and brackets, exemptions and deductions, the administrative framework, social and economic impacts, and the global economic context. By examining each of these facets, we seek to unravel the underlying dynamics that distinguish the tax systems of these two South Asian nations.

Tax Rates and Brackets: A Comparative Lens

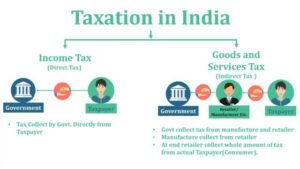

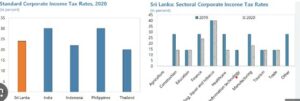

- India, as one of the world’s most dynamic economies, has undergone significant reforms in recent years, including an overhaul of its income tax system. The introduction of the Goods and Services Tax (GST) marked a monumental shift in the indirect tax landscape. On the direct tax front, the government introduced a new optional concessional tax regime. Under this regime, individuals have the choice to pay taxes at reduced rates without availing various exemptions and deductions.

- On the other hand, Sri Lanka maintains a traditional progressive tax structure with multiple income brackets, where higher incomes face higher tax rates. Understanding the nuances of these tax rate structures is crucial in deciphering the underlying philosophies guiding each nation’s approach to individual income taxation.

- In the fiscal year 2020-21, India introduced optional concessional tax rates, offering individuals an alternative to the existing tax regime. This initiative seeks to simplify the tax structure and alleviate compliance burdens. However, the decision between the two systems hinges on factors like income levels and the significance of specific exemptions. This structure embodies a nuanced balance between revenue requirements and the promotion of investments and expenditures.

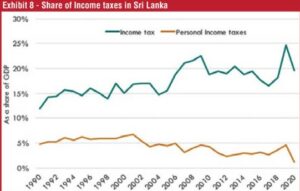

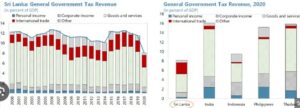

- Conversely, Sri Lanka’s tax structure embodies a progressive system, featuring varying rates for distinct income brackets. This traditional approach resonates with the global norm, wherein higher-income individuals contribute a larger proportion of their earnings to government revenue. By contrasting these structures, we glean insights into how each country endeavors to attain equity and fiscal sustainability within its unique economic context.

- Examining the progression of tax rates in both countries enables us to discern patterns in the distribution of tax burdens. Are higher income groups in India incentivized to opt for the concessional tax rates, and how does this compare with the burden borne by the top earners in Sri Lanka? Unraveling such intricacies provides a nuanced understanding of the motivations behind the tax rate structures in both nations.

Exemptions and Deductions: Incentivizing Investments and Expenditures

- The complexity of individual income taxation often stems from the numerous exemptions and deductions provided by tax codes. In India, deductions under various sections of the Income Tax Act, such as Section 80C for investments in specified instruments and Section 80D for health insurance premiums, aim to incentivize savings and expenditures in specific areas. These deductions play a vital role in the tax planning strategies of individuals, influencing their financial decisions.

- Sri Lanka, within its tax code, similarly offers exemptions for specific income sources, adding to the overall complexity of the tax structure. Grasping the differences in these provisions is crucial for unraveling the targeted areas where each country seeks to stimulate economic activity and promote social welfare.

- India’s tax exemptions and deductions are tailored to accommodate a diverse range of financial activities. From encouraging investments in infrastructure projects to promoting education and healthcare expenditures, these provisions serve as policy tools to influence the economic behavior of individuals. However, the trade-off between incentivizing specific activities and maintaining a streamlined tax code presents a persistent challenge for policymakers.

- Similarly, Sri Lanka’s approach to exemptions and deductions reflects its economic development priorities. Analyzing the nature of these incentives provides insights into the sectors and activities that the government seeks to bolster. For instance, are there specific exemptions aimed at fostering small and medium enterprises, or do deductions focus on promoting sustainable practices?

- The comparative examination of exemptions and deductions reveals the contrasting strategies India and Sri Lanka employ to attain their socio-economic goals. Does one nation prioritize incentivizing individual savings, while the other concentrates on fostering investments in pivotal sectors? Unraveling these details unveils the underlying motivations driving tax policy decisions.

Administrative Framework: Balancing Efficiency and Compliance Ease

- Effective implementation of tax policies heavily relies on the administrative framework supporting them. In India, the Income Tax Department oversees tax administration, leveraging digital advancements such as the PAN (Permanent Account Number) system to enhance efficiency. The introduction of technologies like Aadhaar, a biometric identification system, further streamlines the verification process and reduces tax evasion.

- Conversely, Sri Lanka has established its own revenue authority, the Inland Revenue Department, to administer taxes. The nation employs a unique tax identification system, which, while distinct from India’s, serves the same purpose of facilitating efficient tax administration. A comparative analysis of administrative frameworks allows us to evaluate the ease of compliance for taxpayers in both nations.

- India’s emphasis on digitalization and the use of technology in tax administration reflects a commitment to reducing bureaucratic hurdles and enhancing transparency. The PAN system, introduced to uniquely identify taxpayers, has played a pivotal role in curbing tax evasion and improving the overall efficiency of the tax system.

- In Sri Lanka, the establishment of a separate revenue authority underscores the nation’s dedication to creating a specialized entity focused on tax administration. By exploring the efficiency of this administrative structure, we gain insights into the nation’s capacity to adapt to evolving tax challenges and ensure a fair and effective tax collection process.

- Comparing the administrative frameworks of India and Sri Lanka extends beyond the technological aspects. It involves an assessment of the responsiveness of tax authorities to taxpayer needs, the efficacy of dispute resolution mechanisms, and the overall efficiency of the tax collection process. Understanding these dynamics provides a comprehensive picture of the administrative strengths and challenges faced by each nation.

Social and Economic Impacts: Beyond Numbers to Real-world Consequences

- Moving beyond numerical aspects, an in-depth exploration of the social and economic impacts of individual income taxation is crucial. The primary goal of any tax system is not only to generate revenue but also to contribute to broader socio-economic objectives such as income distribution, poverty alleviation, and economic equality.

- In India, the impact of individual income taxation on income distribution is multifaceted. The progressive nature of the tax system theoretically contributes to reducing income inequality by placing a higher burden on those with higher incomes. However, the effectiveness of this approach is contingent on various factors, including the extent of compliance and the ability of the tax system to capture income from all sources.

- Additionally, the role of exemptions and deductions in shaping social and economic behavior is significant. For example, deductions for investments in affordable housing or contributions to charitable organizations can influence the distribution of resources in society. By critically evaluating the outcomes of these provisions, we gain insights into the extent to which India’s tax system aligns with its broader socio-economic goals.

- In Sri Lanka, the progressive tax structure also aims to address income inequality. However, the effectiveness of this approach is contingent on various factors, including the degree of compliance and the ability of the tax system to capture income from diverse sources. By dissecting the impacts on income distribution, we discern the effectiveness of Sri Lanka’s tax policies in promoting economic equity.

- Beyond income distribution, the socio-economic impacts also extend to poverty alleviation and economic mobility. How do the tax systems of India and Sri Lanka contribute to lifting individuals out of poverty, and are there mechanisms in place to ensure that taxation does not exacerbate existing economic disparities? By exploring these questions, we move beyond the theoretical aspects of tax policy to understand its tangible effects on the lives of individuals in both nations.

Global Economic Context: Navigating Cross-border Challenges

- Both India and Sri Lanka operate within a global economic context, confronting challenges such as tax evasion, cross-border investments, and international tax cooperation. Analyzing how each country navigates these challenges provides insights into their global economic integration strategies and adherence to international norms.

- India, as a major player in the global economy, grapples with the complexities of cross-border taxation. The presence of multinational corporations and the flow of investments across borders necessitate a robust international tax framework. The country’s approach to issues such as transfer pricing, the taxation of digital transactions, and the prevention of base erosion and profit shifting (BEPS) reflects its commitment to aligning with global standards.

- Sri Lanka, though smaller in economic scale compared to India, faces similar challenges in navigating cross-border tax issues. The nation’s policies on double taxation avoidance agreements (DTAAs), tax treaties, and the taxation of foreign income play a crucial role in attracting foreign investments and ensuring a fair and transparent tax system.

- By comparing the global economic contexts of India and Sri Lanka, we gain insights into their strategies for balancing the need to attract foreign investments with the imperative of safeguarding domestic revenue. How do these countries strike a balance between facilitating international trade and ensuring that multinational corporations contribute their fair share to the national exchequer? Analyzing these aspects provides a nuanced understanding of the role of individual income taxation in the broader global economic landscape.

Conclusion:

Insights and Implications for Policymakers

- As we conclude our comparative analysis of individual income tax structures in India and Sri Lanka, the insights gleaned from this exploration hold significant implications for policymakers, economists, and international observers. The nuanced examination of tax rates and brackets, exemptions and deductions, administrative frameworks, social and economic impacts, and the global economic context offers a holistic understanding of the complexities inherent in crafting effective tax policies.

- The comparative analysis of tax rates and brackets reveals the divergent strategies employed by India and Sri Lanka to balance the need for revenue mobilization with the imperative of incentivizing economic activities. The optional concessional tax regime in India and the progressive tax structure in Sri Lanka represent unique approaches to achieving fiscal sustainability while addressing the socio-economic realities of each nation.

- Exemptions and deductions emerge as powerful tools in shaping individual behavior and influencing economic outcomes. By unraveling the targeted areas for incentivizing investments and expenditures, we gain insights into the socio-economic priorities of each country. Understanding how these provisions contribute to economic growth, social welfare, and environmental sustainability provides valuable lessons for policymakers seeking to fine-tune their tax codes.

- The administrative frameworks of India and Sri Lanka offer a lens through which we can evaluate the efficiency and effectiveness of tax collection processes. The embrace of technology, such as the PAN system in India, and the establishment of dedicated revenue authorities in both nations underscore a commitment to enhancing administrative capabilities. Policymakers can draw lessons from these administrative approaches to streamline tax processes, reduce compliance burdens, and ensure a fair and transparent tax system.

- The social and economic impacts of individual income taxation go beyond mere numbers, delving into the real-world consequences for individuals and communities. The analysis of income distribution, poverty alleviation, and economic mobility provides a critical evaluation of how tax policies contribute to broader socio-economic goals. Policymakers can use these insights to recalibrate tax structures, ensuring that they align with the principles of fairness, inclusivity, and economic progress.

- In the realm of the global economic context, understanding how India and Sri Lanka navigate cross-border challenges sheds light on their strategies for international economic integration. Policymakers can draw inspiration from successful approaches to issues such as double taxation avoidance, tax treaties, and the taxation of foreign income, fostering an environment conducive to global investments while safeguarding domestic revenue interests.

- In conclusion, the comparative analysis of individual income tax structures in India and Sri Lanka goes beyond numerical comparisons to unveil the intricate dynamics that shape fiscal policies. The insights garnered from this study provide a foundation for evidence-based policymaking, facilitating informed decisions that align with the socio-economic priorities of each nation. As the global economic landscape continues to evolve, the lessons learned from this comparative analysis serve as a valuable compass for navigating the complexities of individual income taxation in an ever-changing world.

References ….

https://www.elibrary.imf.org/view/journals/002/2022/341/article-A001-en.xml

https://documents1.worldbank.org/curated/en/231021468740958491/pdf/multi-page.pdf

https://www.jstor.org/stable/3990021

https://www.jstor.org/stable/4395050

https://www.sciencedirect.com/science/article/pii/S0970389617305177

https://www.taxesforexpats.com/country-guides/sri-lanka/us-tax-preparation-in-sri-lanka.html

https://www.tilleke.com/wp-content/uploads/2011/05/Thailand-Tax-Guide.pdf